Solana Memecoins Crashed but the Ecosystem Is Stronger Than Ever

Let's get the ugly part out of the way first.

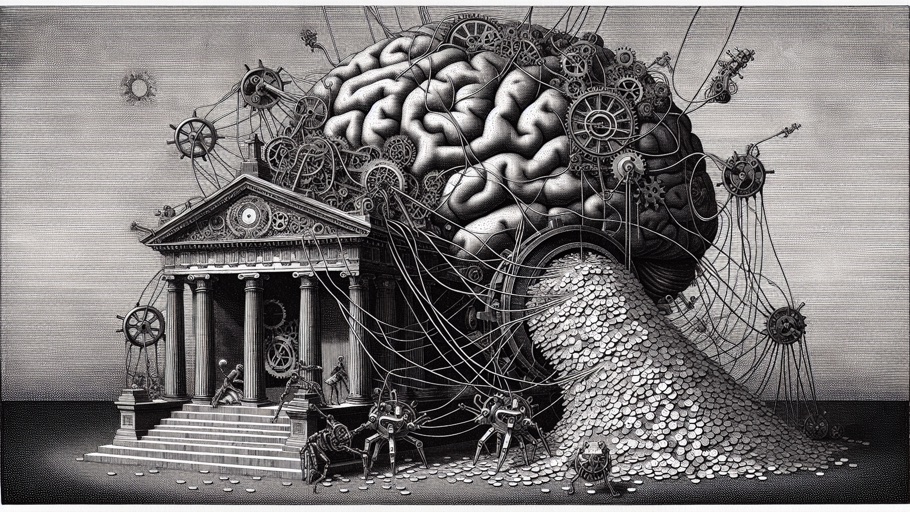

The Solana memecoin bubble was one of the worst things to happen to crypto in 2024-2025. Pump.fun and similar launchpads made it trivially easy to create tokens. Millions of memecoins were launched. Celebrity tokens, political tokens, animal tokens, tokens that were literally called "rugpull." Most went to zero. Many were outright scams. Billions of dollars in retail money evaporated.

The TRUMP and MELANIA token launches were particularly damaging. Political memecoins that pumped on headline attention and crashed 90%+, leaving ordinary people holding worthless tokens while insiders cashed out. It was embarrassing for the entire industry.

SOL sits around $83 today. Down significantly from its cycle highs. The memecoins are largely dead.

But here's the thing nobody wants to hear: Solana the ecosystem is actually thriving.

The Numbers Don't Lie

Strip away the memecoin noise and look at what's actually being built on Solana.

Daily transaction volume consistently exceeds most other chains. Even after the memecoin crash, Solana processes more non-token-creation transactions than most L2s. The validator set is distributed across thousands of nodes in dozens of countries.

Solana DeFi has matured dramatically. Jupiter, the leading DEX aggregator, processes billions in weekly volume. Marinade Finance handles liquid staking. Drift Protocol runs perpetual futures. Raydium and Orca provide deep AMM liquidity. These aren't fly-by-night projects. They're battle-tested protocols with real users.

The Solana DePIN ecosystem (Helium, Render, Hivemapper) has found actual product-market fit in ways that few crypto projects can claim. Helium's mobile carrier network has real subscribers. Render processes actual GPU compute jobs. These are businesses, not just tokens.

Why Solana Survived the Memecoin Crash

Other chains that went through memecoin bubbles were damaged permanently. Think about EOS after its ICO bubble. Or various BSC tokens after the 2021 rug-pull epidemic. The chain's reputation was so tarnished that serious developers left.

Solana avoided that fate for three reasons:

The serious builders never left. The developers working on Jupiter, Marinade, Drift, and the core Solana runtime didn't stop building when memecoins were hot. They just kept shipping. When the memecoin tourists left, the infrastructure they built remained.

Technical improvements continued. Solana's Firedancer client, developed by Jump Crypto, is a complete rewrite of the validator software that promises dramatic performance improvements. The state compression technology that makes compressed NFTs and tokens possible is genuine innovation. These advances don't get headlines, but they make the chain fundamentally better.

The developer experience improved. Anchor framework updates, better documentation, local development tools, and the growing Rust ecosystem have made building on Solana significantly easier. The developer surveys consistently show Solana as one of the top chains for developer satisfaction.

The Post-Memecoin Identity

Solana is in the process of figuring out what it is when it's not a memecoin casino. And the answer is shaping up to be interesting.

DePIN hub. More DePIN projects build on Solana than any other chain. The combination of high throughput, low costs, and a vibrant community makes it the natural home for decentralized physical infrastructure. Helium's migration from its own chain to Solana validated this positioning.

Trading infrastructure. Jupiter isn't just a DEX aggregator. It's becoming a full trading platform with limit orders, DCA strategies, and perpetuals. The vision is to make Solana the best chain for trading anything, from crypto assets to eventually tokenized stocks and commodities.

Payments. Solana's fast finality and near-zero fees make it well-suited for payments. Visa's stablecoin settlement pilot chose Solana. Shopify has integrated Solana Pay. The payments narrative is still early, but the infrastructure is in place.

Mobile. Solana Saga 2, the second-generation crypto phone, is pushing the idea of mobile-native crypto. It's still niche, but the concept of a chain with dedicated mobile hardware is unique.

SOL the Token

SOL at $83 with a market cap of about $47 billion is a complicated valuation.

The bull case: Solana has the second-most active developer ecosystem after Ethereum. It's the fastest major blockchain. DeFi and DePIN are growing. Institutional interest is building (a Solana ETF is being explored). If Solana becomes the "performance layer" of crypto where apps that need speed and low costs live, $83 is cheap.

The bear case: SOL has underperformed BTC significantly. The memecoin reputation damage will take time to heal. Network outages, though less frequent than before, still happen. And there's no Solana ETF yet, meaning it lacks the institutional demand tailwind that Bitcoin has.

My read: SOL is one of the better risk-reward bets in the large-cap altcoin space. Not because of price speculation, but because the ecosystem is genuinely building useful things. The question is whether the market cares about utility or just follows ETF flows and narrative momentum.

The Lesson Nobody Wants to Learn

The memecoin crash on Solana tells a broader story about crypto cycles.

Every chain that achieves critical mass goes through a speculation phase. Ethereum had ICOs. BSC had yield farms and rug pulls. Solana had memecoins. The speculation attracts users, brings attention, and ultimately crashes.

What matters is what's left after the crash. Ethereum after the ICO bust had Uniswap, Aave, Compound, and Maker. The foundations of DeFi. BSC after its crash had... mostly PancakeSwap and Venus. Not nothing, but thin.

Solana after the memecoin crash has Jupiter, Marinade, Helium, Render, Drift, Jito, Tensor, and a growing list of serious projects. That's a real ecosystem. It's not as deep as Ethereum's, but it's deeper than any other alt-L1.

My Take

If you're writing off Solana because of memecoins, you're making the same mistake people made when they wrote off Ethereum because of failed ICOs. The speculation was dumb. The chain is real.

Solana at $83 is beaten down, post-narrative, and boring. Which, historically speaking, is exactly when you should be paying attention to it.

The memecoin era was Solana's worst chapter. What comes next might be its best.

Related Articles

An AI Wrote the Code That Just Drained $1.8 Million From a DeFi Protocol

A pricing glitch that lasted only minutes left DeFi lender Moonwell with $1.8 million in bad debt. The faulty code was co-authored by Claude Opus 4.6, an AI coding assistant. We've officially entered the era of AI-generated exploits.

DeFi Is Not Dead. It's Just Getting Boring.

Everyone says DeFi is dead because the 1000% APYs disappeared. The truth is DeFi is actually working now. It's just not exciting anymore. And that's the point.

Aave Just Hit $30 Billion TVL in the Middle of a Bear Market

While most of crypto is licking its wounds, Aave quietly became the second-largest protocol in DeFi. How did a lending protocol built in 2020 outlast everything around it?