The Real Yield Narrative Is Back and It's Different This Time

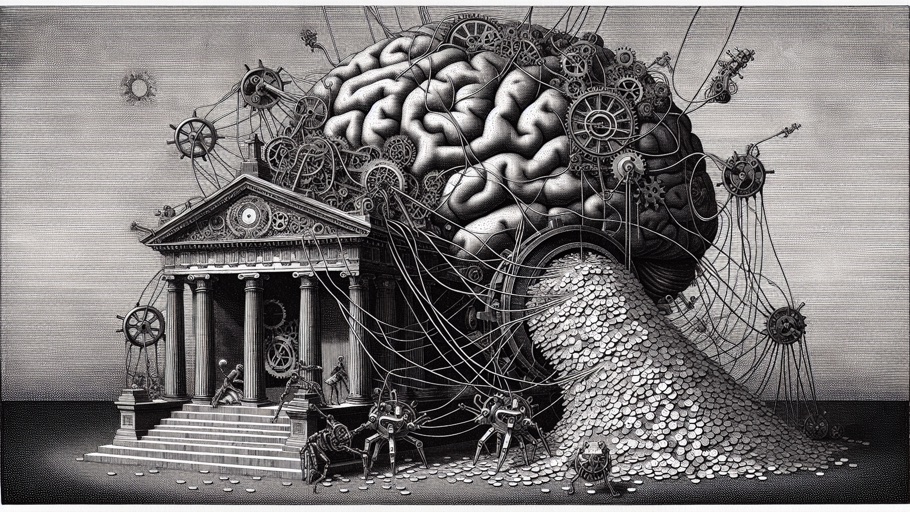

Remember "real yield"? It was the narrative that emerged from the wreckage of DeFi summer. After Olympus forks imploded, after Luna evaporated $40 billion, after every unsustainable yield farming scheme collapsed, the surviving protocols adopted a new mantra: "We generate real revenue."

That was 2022. It was a good narrative. But it was premature. Most protocols claiming "real yield" were generating a few thousand dollars a day. Hardly enough to justify billion-dollar valuations.

Now, in 2026, real yield is back. And this time the numbers actually support it.

What Real Yield Actually Means

Let's define terms because this phrase gets thrown around loosely.

Real yield means protocol revenue that comes from actual user activity, not from token emissions. When Aave earns interest rate spreads from borrowers, that's real yield. When Uniswap collects trading fees, that's real yield. When GMX takes a cut of perpetual futures trading, that's real yield.

What's NOT real yield: paying stakers in your own token. That's inflation, not revenue. If a protocol promises 200% APY paid in its governance token, that's not yield. It's dilution dressed up as income. The token inflates, the price drops, and you end up with more tokens worth less money.

The 2021 DeFi bubble was built almost entirely on fake yield. Projects minted tokens out of thin air, distributed them as "rewards," and called it APY. It worked until it didn't.

The Protocols That Actually Earn Money

Here are the DeFi protocols generating meaningful real revenue right now:

Aave. North of $33 billion TVL, earning tens of millions annually from interest rate spreads. The spread between what depositors earn and what borrowers pay goes to the protocol treasury and AAVE stakers.

Lido. The largest liquid staking protocol charges a 10% fee on all staking rewards. With $34 billion in staked ETH generating roughly 3% APR, Lido's annual revenue is substantial. It's split between the DAO and node operators.

Uniswap. Billions in daily trading volume, with 0.01% to 1% fees depending on the pool. The Uniswap protocol itself hasn't activated its fee switch for token holders yet, but LP fees are real revenue for liquidity providers.

Maker/Sky. The protocol behind DAI generates revenue from stability fees (interest on DAI loans) and from deploying collateral into US Treasury bills. MakerDAO pioneered the RWA integration that now generates millions in weekly revenue.

GMX. The perpetual futures DEX on Arbitrum and Avalanche distributes 30% of all fees to GMX stakers in ETH and AVAX. That's real yield paid in blue-chip assets, not protocol tokens.

Why This Time Is Different

The real yield narrative of 2022 was aspirational. Protocols were saying "we earn real revenue" while generating barely enough to cover team salaries. The market shrugged.

Three things have changed:

Scale is real now. Aave didn't have $33 billion in TVL in 2022. It had maybe $5-8 billion. GMX wasn't doing billions in daily volume. Lido wasn't staking $34 billion. The revenue base has grown 3-5x for the surviving protocols, making the yield actually meaningful.

Token incentives have been slashed. Most mature protocols have dramatically reduced their token emissions. Aave doesn't need to bribe liquidity providers with massive AAVE emissions anymore. The product attracts deposits because the yields are competitive. Less inflation means the real yield isn't diluted away.

TradFi integration is generating new revenue. Maker's investment of collateral into Treasury bills was pioneering. Now multiple protocols earn yield from RWAs (real-world assets). This creates a yield floor that doesn't depend on crypto market activity. Even during quiet markets, T-bill yields keep flowing.

The Yield Comparison That Matters

Let's do the math that actually matters. What can you earn in DeFi today vs. traditional finance?

Stablecoin lending on Aave: 4-8% APY depending on the asset and chain. This is paid from borrower interest, not token emissions.

USDC in a money market fund: ~5% APY with no smart contract risk.

The gap has narrowed. But there are reasons the DeFi yield can command a premium:

Permissionless access. No KYC, no minimums, no geographic restrictions. Anyone with an internet connection can earn yield on Aave.

Composability. You can deposit USDC into Aave, receive aUSDC, and use that receipt token in other protocols. Your yield compounds across multiple layers.

Speed. Withdraw instantly, 24/7. No waiting for bank transfers or redemption periods.

But you're taking on smart contract risk, oracle risk, and regulatory risk that don't exist in a money market fund. The question every investor needs to answer: is the extra 1-3% yield worth those risks?

The Fee Switch Debate

Uniswap is at the center of a critical question: should protocols turn on their fee switches and share revenue with token holders?

Right now, all Uniswap trading fees go to liquidity providers. Zero goes to UNI token holders. The protocol governance could activate a fee switch that redirects a portion of fees to the treasury or to stakers, but it hasn't happened yet.

Why? Partly legal concerns (distributing fees might make UNI look more like a security). Partly because LPs might leave if their share decreases. Partly because the foundation has enough runway from the initial token allocation.

But the pressure is building. Token holders are frustrated watching billions in fees flow to LPs while UNI trades at $3.40 with limited value accrual. If the fee switch activates, it could be a major catalyst for UNI and for the broader "real yield" narrative.

What to Watch For

Revenue durability. Crypto market activity is cyclical. DeFi revenue booms during bull markets and contracts during bear markets. The protocols that generate real yield through all market conditions (like Maker with its T-bill revenue) are more valuable than those dependent on high trading volumes.

Fee compression. As more protocols compete for the same users, fees will come down. Aave's interest spreads could narrow. DEX fees could drop. This is natural market dynamics, but it pressures revenue growth.

Regulatory risks. If regulators classify DeFi lending as banking, or DEX trading as brokerage, the compliance costs could wipe out the revenue advantage over traditional finance.

Sustainability of emissions reduction. Some protocols have reduced token emissions temporarily. Watch whether they can maintain this discipline or resort to emission-funded growth again during the next bull market.

My Take

Real yield is the only narrative in DeFi that actually matters for long-term value creation. Everything else, narrative tokens, meme coins, airdrop farming, is entertainment. Real yield is fundamentals.

The protocols earning genuine revenue today are the ones that will survive the next crash, attract institutional capital, and eventually be valued like real businesses. Aave, Lido, Maker, GMX, and a handful of others are building the foundation of a legitimate financial system.

If you're looking for exposure to DeFi, focus on protocols with real revenue, not ones promising unsustainable APYs funded by token inflation. The boring protocols with 5-10% real yields are going to outperform the exciting ones with 200% fake yields. Every single time.

Related Articles

An AI Wrote the Code That Just Drained $1.8 Million From a DeFi Protocol

A pricing glitch that lasted only minutes left DeFi lender Moonwell with $1.8 million in bad debt. The faulty code was co-authored by Claude Opus 4.6, an AI coding assistant. We've officially entered the era of AI-generated exploits.

Solana Memecoins Crashed but the Ecosystem Is Stronger Than Ever

The memecoin mania on Solana burned billions. But underneath the wreckage, the chain's infrastructure, DeFi, and developer ecosystem are in the best shape they've ever been.

DeFi Is Not Dead. It's Just Getting Boring.

Everyone says DeFi is dead because the 1000% APYs disappeared. The truth is DeFi is actually working now. It's just not exciting anymore. And that's the point.